Value Investing

If you’re looking at equities, NSE leads, but BSE offers niche opportunities. For commodities, MCX is the top choice, while NeML is revolutionizing rural markets with digital solutions.

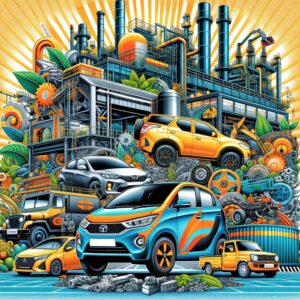

When analyzing the automobile sector in India, Tata Motors, Mahindra & Mahindra, and Maruti Suzuki emerge as three pivotal players, each holding significant market share and brand influence. This detailed comparison delves into various facets of these companies, including financial indicators, stock price trends, business models, segments, future strategies, strengths, weaknesses, profit formulas, investors, customers, market capitalization, and recent developments.

Tata Motors, part of the larger Tata Group, is known for its diverse range of vehicles, including passenger cars, trucks, vans, coaches, buses, luxury cars, and construction equipment. Financially, Tata Motors has shown resilience despite fluctuations, with notable investments in electric vehicles (EVs) impacting its fiscal reports. The stock price of Tata Motors has experienced volatility, reflecting global economic conditions, input cost variations, and market demand shifts.

Mahindra & Mahindra stands out for its strong presence in the utility vehicle and tractor sectors. The company’s financial health is robust, characterized by solid revenue from automotive and farm equipment sectors. Stock price trends for Mahindra & Mahindra often correlate with its agricultural sector performance, technological advancements, and market expansion strategies.

Maruti Suzuki is India’s market leader in passenger vehicles, known for its extensive dealership network and strong customer loyalty. Financially, Maruti maintains a consistent growth trajectory, with a focus on operational efficiency and market penetration. Its stock performance has been relatively stable, reflecting its dominant market position and consistent demand for its models.

Tata Motors’ business model encompasses a wide array of automotive products and services, targeting various market segments. It has a significant international presence and is investing heavily in EVs and sustainable technologies, aiming to diversify its portfolio and reduce dependency on traditional combustion engines.

Mahindra focuses on utility vehicles, tractors, and information technology services, with a growing emphasis on sustainability and innovation. Its business model leverages its strong brand in rural markets and expands into electric mobility and farm equipment technologies.

Maruti Suzuki’s business model is centered on mass-market passenger vehicles, prioritizing affordability, fuel efficiency, and widespread service network. It excels in market penetration and customer satisfaction, focusing on compact cars while gradually expanding into the SUV segment and exploring electric models.

Tata Motors aims to be a frontrunner in the EV space, capitalizing on global trends towards sustainability. It seeks to enhance its international footprint and product range, focusing on innovative designs and technologies.

Mahindra is investing in next-gen technologies, including electric vehicles and autonomous agricultural equipment, aiming to maintain its leadership in the utility segment while exploring new markets and partnerships.

Maruti Suzuki is concentrating on strengthening its hold in the compact car segment while diversifying into electric vehicles and improving its technological capabilities to meet evolving consumer preferences.

Strengths: Diverse portfolio, strong R&D, global presence. Weaknesses: High debt levels, dependency on commercial vehicle segment. Profit Formula: Broad product range, strategic partnerships, focus on innovation.

Strengths: Dominance in UV and tractor segments, brand equity in rural markets. Weaknesses: Limited global presence, electric vehicle segment in nascent stage. Profit Formula: Market leadership in core segments, diversification into new technologies.

Strengths: Market leader in passenger vehicles, vast dealership network. Weaknesses: Less diversified product portfolio, emerging presence in electric vehicles. Profit Formula: Volume sales, operational efficiency, customer loyalty.

Investors are attracted to Tata Motors for its comprehensive portfolio and future readiness. Customers appreciate the brand’s innovation and product quality. Its market capitalization reflects its significant global footprint and investment in future technologies.

Investors favor Mahindra for its strong position in niche segments and strategic ventures into new technologies. It has a loyal customer base, particularly in the utility and farm sectors. The company’s market capitalization is indicative of its solid market presence and growth potential.

Maruti Suzuki’s consistent market performance and brand trust attract investors. Its widespread acceptance among customers, especially in the mass-market segment, supports its market capitalization, highlighting its industry dominance.

Recent developments at Tata Motors include expanding its EV lineup, entering new international markets, and investing in autonomous driving technologies.

Mahindra has recently launched new models in the utility segment, invested in agritech, and formed alliances for electric mobility solutions.

Maruti Suzuki’s recent focus is on introducing more SUVs, advancing in hybrid technology, and planning for future EV offerings.

If you’re looking at equities, NSE leads, but BSE offers niche opportunities. For commodities, MCX is the top choice, while NeML is revolutionizing rural markets with digital solutions.

Mastek, Persistent Systems, KPIT, and Mphasis cater to different IT segments. KPIT leads in automotive software (high growth, expensive valuation). Persistent is strong in digital transformation, Mphasis in BFSI, and Mastek in cloud ERP (UK-focused). Persistent offers a balance of growth and valuation, while KPIT has industry tailwinds.

Kaveri Seeds, UPL, Bayer CropScience, and Rasi Seeds are key players in India’s agribusiness sector. Kaveri and Rasi dominate hybrid seeds, while UPL leads agrochemicals. Bayer excels in biotech but faces regulatory hurdles. UPL offers high growth but carries debt, while Kaveri and Bayer provide stable investment potential.