Value Investing

If you’re looking at equities, NSE leads, but BSE offers niche opportunities. For commodities, MCX is the top choice, while NeML is revolutionizing rural markets with digital solutions.

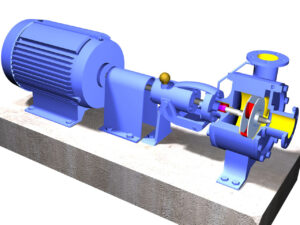

Shakti Pumps (India) Limited (BSE: 531431, NSE: SHAKTIPUMP): Founded in 1982, Shakti Pumps is a leading manufacturer of energy-efficient submersible pumps, solar pumps, pressure booster pumps, and pump motors. The company is known for its strong emphasis on innovation, particularly in solar pump technology. Shakti Pumps operates in various sectors including agriculture, industrial, domestic, and sewage.

Kirloskar Brothers Limited (BSE: 500241, NSE: KIRLOSBROS): Established in 1888, KBL is one of India’s oldest and most reputed pump manufacturing companies. The company offers a wide range of products including centrifugal pumps, valves, and hydro turbines. KBL serves various industries such as agriculture, oil and gas, power, and water supply.

KSB Limited (BSE: 500249, NSE: KSB): KSB Limited, part of the global KSB Group, has been operating in India since 1960. It specializes in high-quality pumps and valves used in sectors like water treatment, building services, energy, and industry. KSB is known for its engineering excellence and innovative solutions.

Roto Pumps (BSE: 517500): Founded in 1968, Roto Pumps is a leading manufacturer of positive displacement pumps, including progressive cavity pumps and twin screw pumps. The company caters to industries such as oil and gas, food and beverage, wastewater treatment, and chemicals.

Shakti Pumps:

KBL:

KSB:

Roto Pumps:

Shakti Pumps:

KBL:

KSB:

Roto Pumps:

Shakti Pumps:

KBL:

KSB:

Roto Pumps:

Shakti Pumps:

KBL:

KSB:

Roto Pumps:

Shakti Pumps:

KBL:

KSB:

Roto Pumps:

Shakti Pumps, KBL, KSB Limited, and Roto Pumps are prominent players in the pump manufacturing industry, each with unique strengths and market strategies. Shakti Pumps leads in solar technology, KBL boasts a broad product range and historical brand value, KSB excels in high-quality and innovative solutions, and Roto Pumps specializes in positive displacement pumps. While each company faces intense competition, their distinct approaches to innovation, market expansion, and customer focus position them uniquely in the industry.

If you’re looking at equities, NSE leads, but BSE offers niche opportunities. For commodities, MCX is the top choice, while NeML is revolutionizing rural markets with digital solutions.

Mastek, Persistent Systems, KPIT, and Mphasis cater to different IT segments. KPIT leads in automotive software (high growth, expensive valuation). Persistent is strong in digital transformation, Mphasis in BFSI, and Mastek in cloud ERP (UK-focused). Persistent offers a balance of growth and valuation, while KPIT has industry tailwinds.

Kaveri Seeds, UPL, Bayer CropScience, and Rasi Seeds are key players in India’s agribusiness sector. Kaveri and Rasi dominate hybrid seeds, while UPL leads agrochemicals. Bayer excels in biotech but faces regulatory hurdles. UPL offers high growth but carries debt, while Kaveri and Bayer provide stable investment potential.