MECE is a structured problem-solving principle commonly used in management consulting to ensure clarity, completeness, and logical consistency in analysis and decision-making. It is fundamental in frameworks developed by top consulting firms, such as McKinsey & Company.

Key Aspects of MECE

- Mutually Exclusive (ME) – Each category or segment in a breakdown should be distinct, with no overlap. This prevents redundancy and confusion in analysis.

- Collectively Exhaustive (CE) – The categories should comprehensively cover all possibilities, leaving no gaps in the analysis.

By applying MECE, consultants can structure problems in a logical way, ensuring that all elements are considered without duplication or omission.

Applications of MECE in Consulting

- Problem Structuring: Helps break down complex problems into manageable components.

- Market Segmentation: Ensures customer groups do not overlap while covering the entire market.

- Financial Analysis: Helps categorize revenue streams or cost drivers without double-counting or missing any factor.

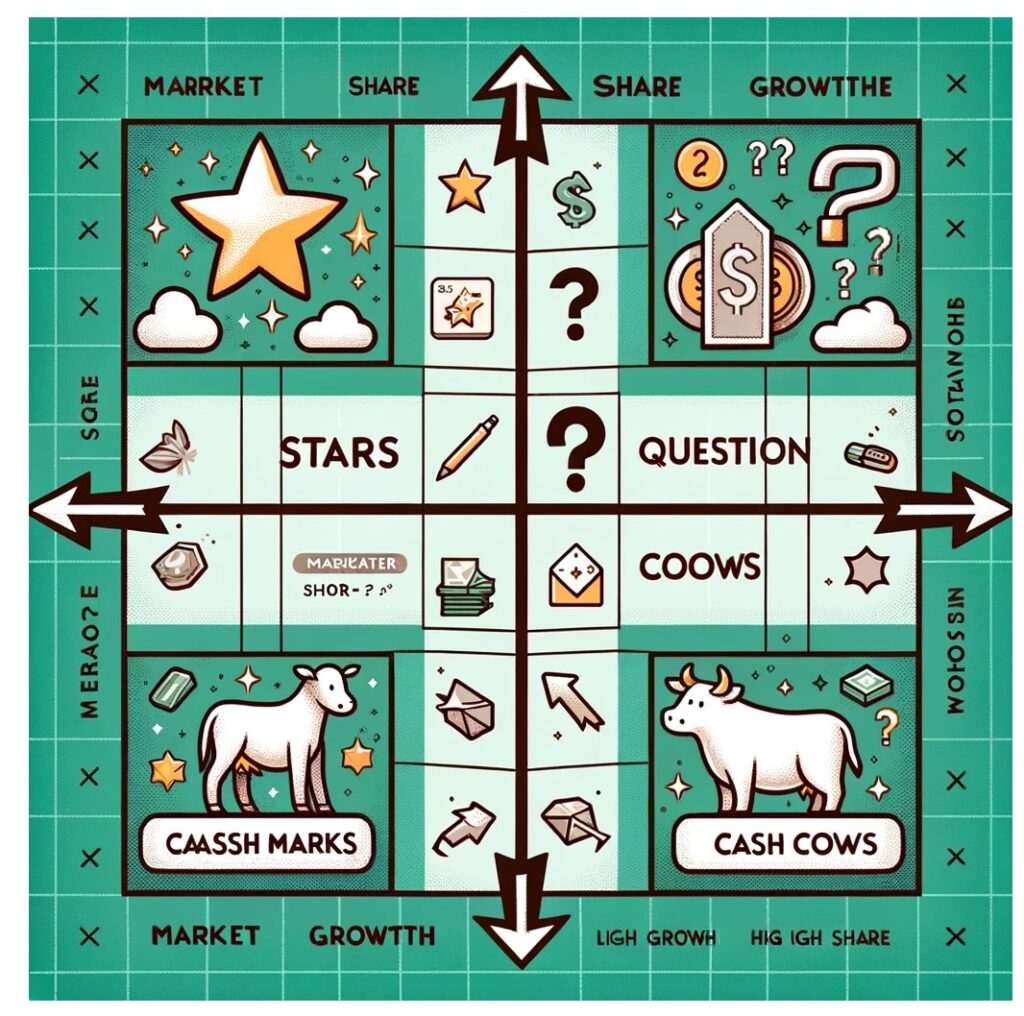

- Strategic Decision-Making: Structures business strategies into well-defined, non-overlapping areas for better analysis.

Example of MECE Application

Imagine a company analyzing its revenue sources. A MECE framework would categorize revenue in a way that ensures no overlap while covering all possible sources:

✅ By Product Line: Product A, Product B, Product C (no overlap, covers all products)

✅ By Geography: North America, Europe, Asia-Pacific (distinct regions, covering all)

❌ By Sales Channel & Geography: If combined carelessly, online sales in North America might overlap with North America as a region, violating MECE principles.

Similar Tools and Methodologies

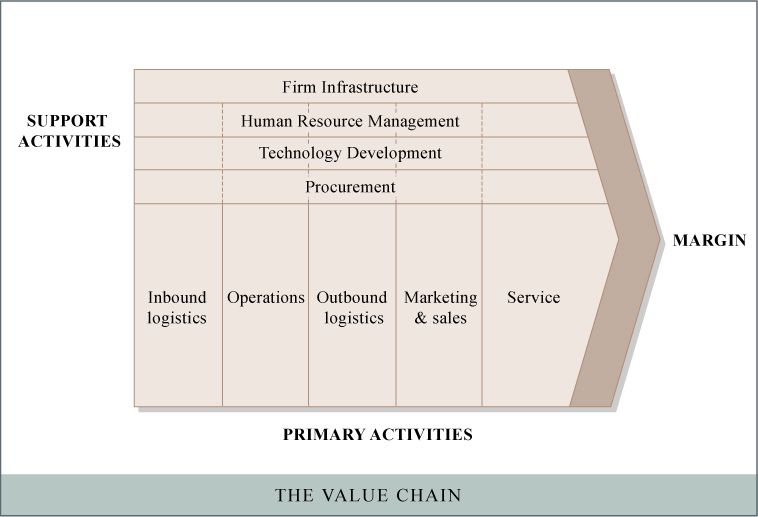

- Issue Trees – A structured breakdown of problems into smaller, MECE-compliant subproblems.

- Decision Trees – Used in decision-making to ensure logical, exhaustive consideration of options.

- Porter’s Five Forces – Analyzes competitive dynamics but should be structured in a MECE way.

- SWOT Analysis – Strengths, Weaknesses, Opportunities, and Threats, but should avoid overlap.

- SCQ Framework (Situation-Complication-Question) – Helps in structuring problem statements systematically.