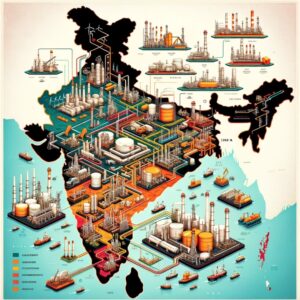

In this comprehensive analysis, we delve into a comparative study of four major players in India’s energy sector: Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL), Indian Oil Corporation Limited (IOCL), and Reliance Industries Limited (RIL). These companies, while operating in the same broader energy and petroleum sector, have distinct business models, financial health, market positioning, and strategic directions.

Business Models and Segments:

- Bharat Petroleum (BPCL): BPCL is an integrated state-owned oil and gas company with significant operations in refining, marketing, and distribution of petroleum products. Its business segments include Retail, Industrial & Commercial, and Aviation fuel.

- Hindustan Petroleum (HPCL): Similar to BPCL, HPCL is also a state-owned enterprise, focusing on refining and marketing of petroleum products. HPCL has a strong retail distribution network and a significant presence in the lubricants market in India.

- Indian Oil Corporation (IOCL): As the largest public sector oil and gas company in India, IOCL has a vast network of operations, including refining, pipeline transportation, and marketing of petroleum products. IOCL leads in the domestic market share and has diversified business interests across the energy value chain.

- Reliance Industries (RIL): Diversifying from its core petrochemicals business, RIL has expanded into areas like telecommunications, retail, and digital services. The company’s oil-to-chemicals (O2C) division remains a significant contributor to its revenues, but its business model is more diversified compared to its state-owned peers.

Financial Indicators and Stock Price Trends:

BPCL

Based on the available data from Bharat Petroleum Corporation Limited (BPCL) for the fiscal year ending in 2024, we observe some key financial metrics that are crucial for understanding the company’s performance. For the second quarter ending September 30, 2023, BPCL reported sales of INR 1,166,573.4 million, a decrease from INR 1,283,557.2 million in the same period a year earlier. However, the company demonstrated a significant turnaround in profitability, with a net income of INR 82,435.5 million compared to a net loss of INR 3,384.9 million in the prior year.

Other notable financial indicators for this period include a gross margin of 16.2%, an operating margin of 9.28%, and a net profit margin of 6.45%. The return on investment stood at 22.53%, reflecting a positive financial health indicator.

From the balance sheet perspective, as of December 31, 2023, BPCL had total assets of INR 2,110,034.5 million and total liabilities of INR 1,400,209.8 million. The company’s total equity was recorded at INR 709,824.7 million. These figures provide insights into the company’s financial stability and capital structure.

IOCL

For Indian Oil Corporation Limited (IOCL) in the fiscal period ending September 2023, the company’s financial results were notable. The reported revenue stood at INR 205,283.03 crores with a net income after taxes reaching INR 13,713.08 crores. These figures were complemented by an operating income of INR 19,718.77 crores and net income before taxes of INR 18,412.76 crores. The detailed financial breakdown highlighted operating expenses, interest expenses, and depreciation, which played crucial roles in determining the final profit figures for this period.

In a separate analysis, the operating profit, as well as net profit and EPS (earnings per share), were emphasized to provide a more detailed insight into IOCL’s operational efficiency and profitability over recent quarters. The operating profit margin (OPM %) and other critical ratios such as debtors days, inventory days, and the cash conversion cycle were analyzed to offer a comprehensive understanding of the company’s operational performance and financial health over different fiscal periods

RIL

For Reliance Industries Limited (RIL) in the second quarter ending September 30, 2023, the company reported sales of INR 2,559,960 million, an increase from INR 2,528,460 million in the previous year. The net income also rose significantly to INR 173,940 million from INR 136,560 million. This financial performance highlights robust growth in both top-line revenue and bottom-line profit for RIL. The detailed financial analysis from Investing.com India further presents the company’s gross margin at 35.15%, operating margin at 12.53%, and net profit margin at 7.97% for the trailing twelve months (TTM) period.

In addition to this, ICICIdirect.com provides a comprehensive breakdown of Reliance Industries’ performance across various segments for the second fiscal quarter of 2024. Notably, the retail segment showed remarkable growth with a revenue of INR 77,148 crore, marking a 19% increase year over year. Similarly, the digital services (Jio) continued to show a positive trajectory with an operating revenue of INR 26,875 crore, reflecting a growth of 10.7% year over year. The oil-to-chemicals (O2C) segment experienced a revenue decline of 7.3% year over year but saw an EBITDA increase of 36%, indicating improved profitability. Additionally, the oil & gas segment’s revenue surged by 718% year over year, underscoring significant growth in this area

HPCL

For the third quarter of the financial year, HPCL reported a significant profit drop of 89% to ₹529 crore, although its revenue rose to ₹1 lakh crore. This information provides a snapshot of HPCL’s financial health during a specific quarter, reflecting challenges that might have impacted its profitability despite an increase in revenue. Such financial indicators are essential for analyzing the company’s performance over time and in comparison to its peers in the sector

Future Strategy and Developments:

- BPCL: With the Indian government’s divestment plan, BPCL’s future strategy includes enhancing its refining capacities and expanding its retail presence. The company is also focusing on alternative energy and reducing carbon emissions.

- HPCL: HPCL is investing in expanding its refining capacity and improving its marketing infrastructure. The company is also exploring opportunities in natural gas and renewable energy sectors.

- IOCL: IOCL’s strategy involves augmenting its refining capacities, expanding its petrochemical business, and focusing on green energy solutions. The company aims to maintain its leadership position in India’s oil and gas sector.

- RIL: Reliance Industries is aggressively investing in its retail and digital services businesses. In the energy sector, the company focuses on the transition to green energy, with significant investments in solar energy, batteries, and hydrogen.

Market Capitalization and Investors:

As of the latest data, RIL’s market capitalization significantly exceeds that of BPCL, HPCL, and IOCL, reflecting its diversified business model and strong growth prospects in non-energy sectors. While the state-owned enterprises have a stable investor base due to government backing, RIL attracts a broad spectrum of domestic and international investors, especially in its technology and retail ventures.