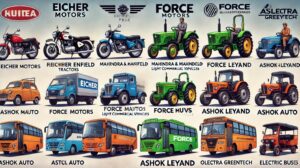

1. Eicher Motors

Business Model and Segments: Eicher Motors operates primarily in the commercial vehicle and motorcycle segments. Its key subsidiary, Royal Enfield, dominates the mid-size motorcycle market. The company also manufactures trucks and buses through its joint venture with Volvo, VECV.

Future Strategies: Eicher focuses on expanding its product range, enhancing its market reach, and investing in electric vehicles (EVs) to align with global automotive trends.

Strengths and Weaknesses: Strengths include a strong brand presence and a robust distribution network. Weaknesses involve heavy reliance on Royal Enfield for revenue and limited exposure in the EV segment.

Profit Formula: Eicher’s profit formula relies on high-margin motorcycles and commercial vehicles, supported by a premium brand image.

Key Investors and Customers: Major investors include institutional investors like mutual funds and foreign institutional investors. Key customers are in the commercial transportation and premium motorcycle markets.

Market Capitalization: As of the latest data, Eicher Motors’ market capitalization stands around ₹85,000 crore.

2. Mahindra & Mahindra

Business Model and Segments: Mahindra operates across multiple segments including automobiles, tractors, financial services, IT, and real estate. The automotive segment includes passenger vehicles, commercial vehicles, and two-wheelers.

Future Strategies: Mahindra focuses on expanding its EV lineup, strengthening its presence in global markets, and leveraging technology to enhance product offerings.

Strengths and Weaknesses: Strengths are a diversified business model, strong brand equity, and leadership in the tractor segment. Weaknesses include low profitability in some non-core segments and challenges in penetrating the premium automotive market.

Profit Formula: The profit formula is driven by high-margin tractors and successful automotive products, supplemented by financial services.

Key Investors and Customers: Key investors are institutional investors and strategic partners. Customers range from individual vehicle buyers to large agricultural and commercial clients.

Market Capitalization: Mahindra & Mahindra has a market capitalization of approximately ₹1,45,000 crore.

3. Force Motors

Business Model and Segments: Force Motors specializes in manufacturing light commercial vehicles (LCVs), multi-utility vehicles (MUVs), and tractors. It also produces engines and axles for automotive and non-automotive applications.

Future Strategies: The company aims to expand its product lineup, enhance manufacturing capabilities, and explore new markets, particularly in the EV segment.

Strengths and Weaknesses: Strengths include a strong presence in the LCV segment and technical expertise in automotive components. Weaknesses involve limited market share in passenger vehicles and insufficient global presence.

Profit Formula: Force Motors’ profits are driven by its commercial vehicles and OEM supply agreements with other automotive manufacturers.

Key Investors and Customers: Major investors include institutional investors and strategic business partners. Customers primarily include commercial fleet operators and OEMs.

Market Capitalization: The market capitalization of Force Motors is around ₹5,000 crore.

4. VST Shakti

Business Model and Segments: VST Shakti focuses on manufacturing power tillers, tractors, and other agricultural equipment. It caters to the small and marginal farmers market.

Future Strategies: The company plans to expand its product portfolio, improve distribution networks, and increase exports to emerging markets.

Strengths and Weaknesses: Strengths include a strong brand in the agricultural segment and a niche market focus. Weaknesses are limited product range and heavy dependence on the Indian market.

Profit Formula: The profit formula is centered on high-volume sales of agricultural equipment and after-sales services.

Key Investors and Customers: Key investors are institutional investors and promoters. Customers include small and marginal farmers and agricultural businesses.

Market Capitalization: VST Shakti has a market capitalization of approximately ₹1,200 crore.

5. Ashok Leyland

Business Model and Segments: Ashok Leyland is a leading manufacturer of commercial vehicles, including trucks, buses, light vehicles, and defense vehicles.

Future Strategies: The company is focused on expanding its electric vehicle portfolio, enhancing its global footprint, and improving operational efficiencies.

Strengths and Weaknesses: Strengths include a strong market position in the commercial vehicle segment and a diversified product range. Weaknesses are cyclical demand in the commercial vehicle sector and high competition.

Profit Formula: Ashok Leyland’s profit formula is driven by high-margin commercial vehicles and defense contracts.

Key Investors and Customers: Major investors include institutional investors and strategic partners. Customers are primarily logistics companies, public transportation bodies, and defense establishments.

Market Capitalization: Ashok Leyland’s market capitalization stands around ₹45,000 crore.

6. Atul Auto

Business Model and Segments: Atul Auto manufactures three-wheelers for passenger and cargo transportation. The company focuses on providing affordable and efficient transportation solutions.

Future Strategies: Atul Auto aims to expand its product lineup, increase its export markets, and explore opportunities in electric three-wheelers.

Strengths and Weaknesses: Strengths include a strong presence in the three-wheeler segment and cost-effective manufacturing. Weaknesses involve limited product diversification and competition from larger players.

Profit Formula: The profit formula is based on high-volume sales of three-wheelers and after-sales services.

Key Investors and Customers: Key investors include institutional investors and promoters. Customers are small business owners and individual transport operators.

Market Capitalization: Atul Auto has a market capitalization of approximately ₹600 crore.

7. Olectra Greentech

Business Model and Segments: Olectra Greentech specializes in manufacturing electric buses and trucks, positioning itself as a key player in the EV segment.

Future Strategies: The company plans to expand its EV product range, increase production capacity, and enhance its technological capabilities.

Strengths and Weaknesses: Strengths include a first-mover advantage in the EV segment and strategic partnerships for technology and distribution. Weaknesses involve high capital requirements and market adoption challenges.

Profit Formula: Olectra’s profit formula is driven by high-value electric vehicle sales and government contracts for public transportation.

Key Investors and Customers: Major investors include institutional investors and strategic partners. Customers are primarily government bodies and public transportation operators.

Market Capitalization: Olectra Greentech’s market capitalization is around ₹6,000 crore.

Conclusion

The comparison of these seven companies reveals a diverse landscape in the Indian automotive industry. Eicher Motors and Mahindra & Mahindra are well-established with diversified portfolios and strong brand equity. Ashok Leyland holds a dominant position in commercial vehicles, while Force Motors and VST Shakti focus on niche markets. Atul Auto specializes in affordable three-wheelers, and Olectra Greentech is a pioneer in the electric vehicle segment. Each company has its unique strengths and strategic focuses, shaping their future trajectories in a rapidly evolving market.