Introduction

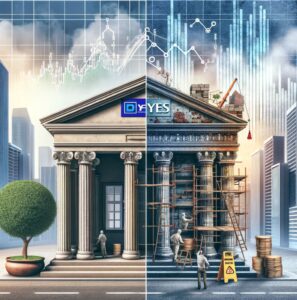

In this analysis, we delve deep into the comparative landscape of HDFC Bank and Yes Bank, two prominent players in the Indian banking sector. While HDFC Bank is renowned for its robust financial health and consistent growth, Yes Bank has experienced considerable volatility in recent years. We will examine various dimensions including financial indicators, stock price trends, business models, segments, future strategies, strengths, weaknesses, profit formulas, key investors, customers, market capitalization, and recent developments.

Financial Indicators and Stock Price Trends

HDFC Bank has been a beacon of stability and growth, showcasing a consistent increase in its revenue and profit margins over the years. The bank’s NPA (Non-Performing Assets) ratios are among the lowest in the industry, reflecting its strong risk management and credit policies. In terms of stock price, HDFC Bank has demonstrated resilience, maintaining an upward trajectory over the last year, underpinned by strong fundamentals and investor confidence.

Yes Bank, on the other hand, has faced significant challenges, with a marked decline in financial performance. The bank’s NPA ratios surged due to exposure to high-risk assets, impacting profitability and eroding investor trust. The stock price of Yes Bank has been volatile, reflecting the bank’s unstable financial position and uncertain future prospects.

Business Models and Segments

HDFC Bank employs a diversified business model, serving a broad spectrum of customers across retail, wholesale, and treasury operations. Its retail banking segment, which includes loans, credit cards, and deposit products, is a major growth driver, contributing significantly to the bank’s profitability. The wholesale banking segment caters to large corporations, offering customized financial solutions.

Yes Bank historically focused on corporate banking, with a significant portion of its loan book concentrated on large corporate clients. This focus led to high exposure to stressed sectors, contributing to its financial woes. In recent years, Yes Bank has been attempting to diversify its portfolio, increasing its presence in retail banking and SME sectors, though these changes are yet to fully stabilize the bank.

Future Strategy, Strength, and Weakness

HDFC Bank plans to continue its growth trajectory by leveraging digital banking, expanding its retail footprint, and targeting underbanked regions. Its strengths lie in its robust financial health, strong brand reputation, and extensive customer base. However, maintaining growth rates in a highly competitive market and managing regulatory compliance are potential challenges.

Yes Bank is focusing on recovery and stabilization, aiming to reduce its NPA levels, strengthen its capital base, and revamp its business strategy. While the bank has the potential to recover given its strong corporate banking franchise, its weaknesses, including a damaged reputation and ongoing financial instability, pose significant hurdles.

Profit Formula, Investors, and Customers

HDFC Bank’s profit formula hinges on its low-cost liabilities, high-quality asset portfolio, and efficient operations, enabling it to deliver superior returns to shareholders. The bank has a diverse investor base, including institutional and retail investors, reflecting its market confidence.

Yes Bank is working to recalibrate its profit formula, focusing on cost optimization and asset quality improvement. Its investor confidence has been shaken, necessitating strategic initiatives to rebuild trust and ensure sustainability.

Market Capitalization and Recent Developments

HDFC Bank has a robust market capitalization, reflecting its industry leadership and financial stability. Recent developments, such as digital innovation initiatives and international expansion plans, have further bolstered its market position.

Yes Bank has seen a significant erosion in its market value due to its financial challenges. However, recent capital infusions and strategic partnerships have provided a glimmer of hope for recovery.

Conclusion

While HDFC Bank stands out for its financial strength, consistent performance, and strategic foresight, Yes Bank faces a challenging path ahead with a focus on recovery and transformation. Investors and stakeholders in these banks must consider these multifaceted aspects to make informed decisions.