In this comparative analysis, KPR Mill and Trident emerge as leaders in terms of financial performance, with strong profitability, low debt, and integrated operations. Welspun India is a global leader in home textiles but faces challenges related to global market fluctuations. Vardhman Textiles is a large and diversified player with strong export credentials, while Siyaram Silk Mills is a smaller, niche player focused on the domestic market. Bombay Dyeing, once a textile giant, is now more of a real estate-focused company, with textiles playing a secondary role. Each company has its strengths, with KPR Mill and Trident standing out for their operational efficiencies and profitability, while Welspun and Vardhman offer scale and market leadership in specific segments.

Value Investing

Value Investment analysis of companies to help you invest better

For Long term investing, always invest when red line is below the black line

This analysis compares four major Indian steel companies—SAIL, Tata Steel, JSW Steel, and JSPL—across various aspects including business models, product offerings, financial performance, and strategic initiatives. Tata Steel and JSW Steel lead in global diversification and financial strength, while SAIL and JSPL focus more on the domestic market with differing levels of debt and profitability challenges.

This analysis examines the business models, market segments, future strategies, strengths, weaknesses, and financial performance of Reliance Industries Limited (RIL), Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL). These companies are pivotal in India’s energy sector, each bringing unique competitive advantages and challenges to the market.

This analysis delves into the business models, market segments, future strategies, strengths, weaknesses, and financial performance of ONGC, GAIL, Oil India Limited, and Vedanta. It highlights their competitive positions, recent developments, and strategic initiatives to provide a comprehensive comparison of these leading Indian energy companies.

This comparison explores the distinct business models, market strategies, and financial metrics of Akums Drugs & Pharmaceuticals Ltd., Alkem Laboratories Ltd., and Mankind Pharma Ltd. Highlighting their strengths, weaknesses, and future plans, it provides a comprehensive overview of their positions in the Indian pharmaceutical industry.

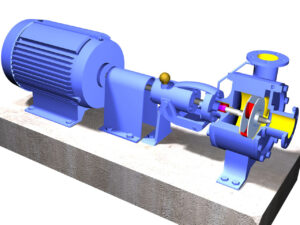

Shakti Pumps, Kirloskar Brothers, KSB Limited, and Roto Pumps are key competitors in the pump industry. Each excels in different segments: Shakti in solar technology, KBL in broad industrial applications, KSB in high-quality engineering, and Roto in positive displacement pumps. Their unique strategies and market positions drive intense competition.

Adani Wilmar, Marico, and ATFL are key competitors in India’s FMCG sector. Adani Wilmar focuses on essential commodities, Marico on health and wellness, and ATFL on innovative food products. Each company leverages its strengths to navigate market challenges and aims for growth through product diversification and strategic expansions.

Gokul Refoils, Kaleesuwari, Vimal Oil, and Adani Wilmar are key competitors in India’s edible oil sector. Gokul Refoils focuses on high-volume sales, Kaleesuwari on brand strength, Vimal Oil on regional market focus, and Adani Wilmar on essential commodities. Each company leverages its strengths to navigate market challenges and aims for growth through product diversification and strategic expansions.

This comparative analysis highlights the distinct business models and strategic approaches of SBI Capital Markets Limited, Indian Railway Finance Corporation, and Housing and Urban Development Corporation. Each institution leverages its unique strengths and faces specific challenges, with a shared focus on supporting India’s infrastructure and development sectors.

This comparative analysis highlights the distinct business models, strengths, and strategic approaches of L&T Finance Holdings Limited, IDFC Limited, and Rural Electrification Corporation Limited. Each institution leverages its unique strengths and faces specific challenges while playing pivotal roles in India’s financial and infrastructure development sectors.

Bharti Hexacom’s IPO, backed by Bharti Airtel, opened with a price band of ₹542-₹570 per share, targeting a ₹4,275 crore raise. The IPO includes a significant anchor investment and reflects strong investor interest, particularly in the competitive Indian telecom landscape. As a provider in key regions, including Rajasthan and the Northeast, Bharti Hexacom stands out amidst major competitors like Vodafone Idea and Reliance Jio

SRM Contractors Limited specializes in heavy civil works, focusing on challenging infrastructure projects like tunnels and bridges, particularly in Jammu and Kashmir. The company’s EPC model enables it to handle complex constructions efficiently, leveraging its leadership and specialized regional expertise for significant infrastructure advancement.

The Bank of Japan’s anticipated end to negative interest rates signals a major policy shift, poised to affect global stock exchanges through currency fluctuations, investment reallocations, and altered risk sentiments. This move reflects broader trends toward interest rate normalization and may prompt strategic adjustments across international financial markets.

Gopal Snacks Limited, a prominent player in the Indian snack food industry, has officially announced its plans to go public through an Initial Public Offering (IPO). This section provides an overview of the company’s background, IPO details, financial performance, market position, and potential impacts on the industry.

Mukka Proteins Limited, an entity venturing into the public market, has attracted attention with its Initial Public Offering (IPO). The discussion here encapsulates the current Grey Market Premium (GMP) associated with Mukka Proteins’ IPO, providing insights into investor sentiment before the shares are officially listed.